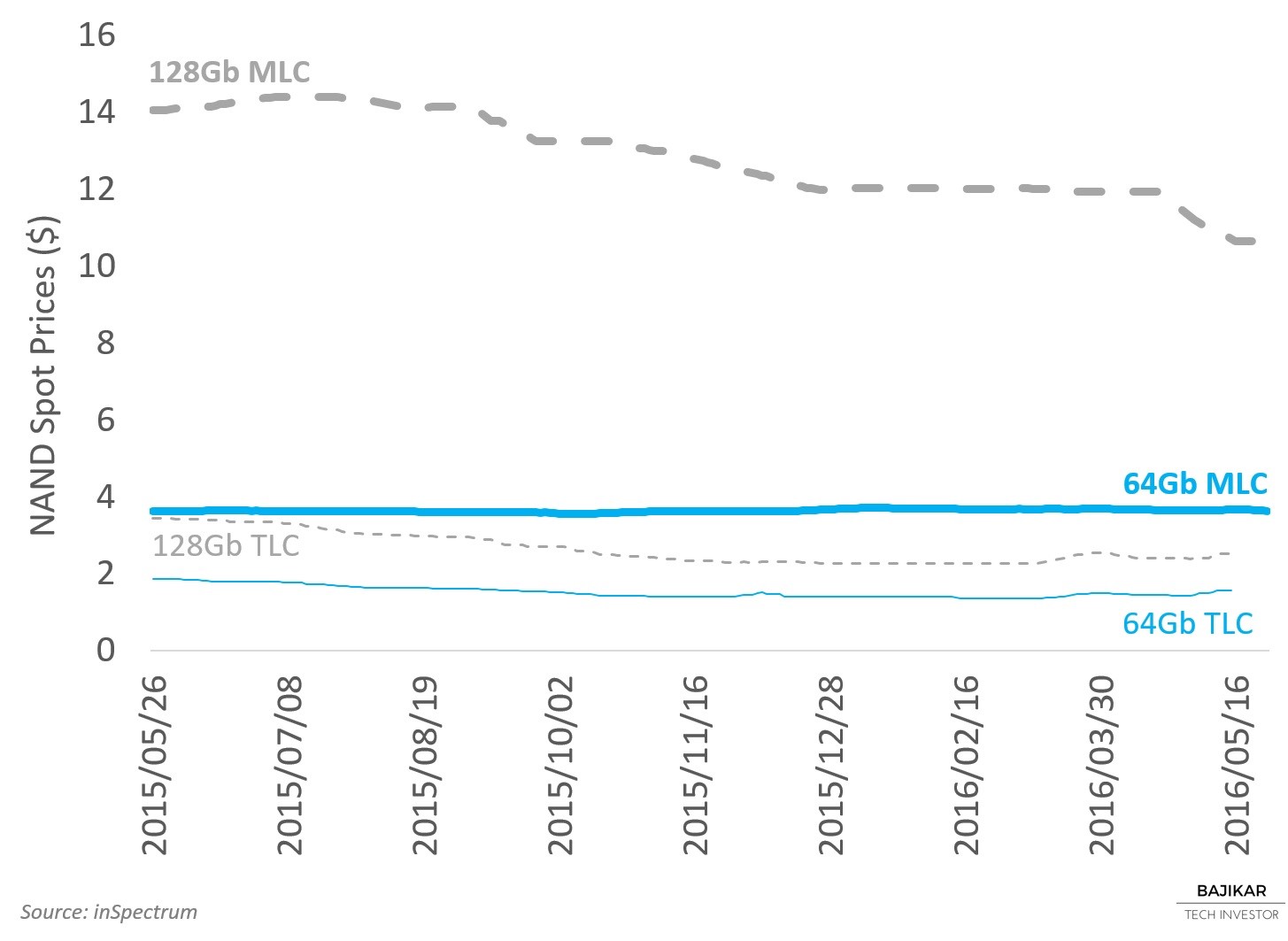

The chart shows NAND spot prices as of May 2016 for 64Gb and 128Gb MLC and TLC NAND components, based on data provided by inSpectrum. According to this data, 128Gb TLC spot prices decreased by ~27% YoY, 128Gb MLC prices decreased ~24%, 64Gb TLC prices decreased ~16%, while 64Gb MLC prices remained stable.

64Gb NAND devices still represent the majority of the market, and the fact that those prices have been relatively stable, or even trending up slightly over the past few weeks, might be foretelling a potential upcoming supply shortage of planar NAND as all NAND makers focus on their transitions to 3D NAND.

According to commentary on its 5/19 earnings call, Applied Materials (AMAT) expects industry NAND CapEx to increase by 35% this year, driven by 3D NAND, while DRAM CapEx decreases at least 25%. While much of this is not entirely new information from my perspective, investors drove AMAT stock up 14% in the trading session following earnings, suggesting investors were previously either not aware of or not fully bought into this dynamic. In my view AMAT is a good example of how value investors can make sizable investment returns in Tech, while underwriting limited idiosyncratic risk, through equity research.

THIS ARTICLE IS NOT AN EQUITY RESEARCH REPORT.

Disclosure: At the time of this writing, the acteve Model Portfolio held long positions in MU stock, but did not hold any positions in AMAT, Samsung Electronics or SK hynix stocks.

Additional Disclosures and Disclaimer

Source: NAND Spot Price data provided by inSpectrum. Stock market data provided by Sentieo