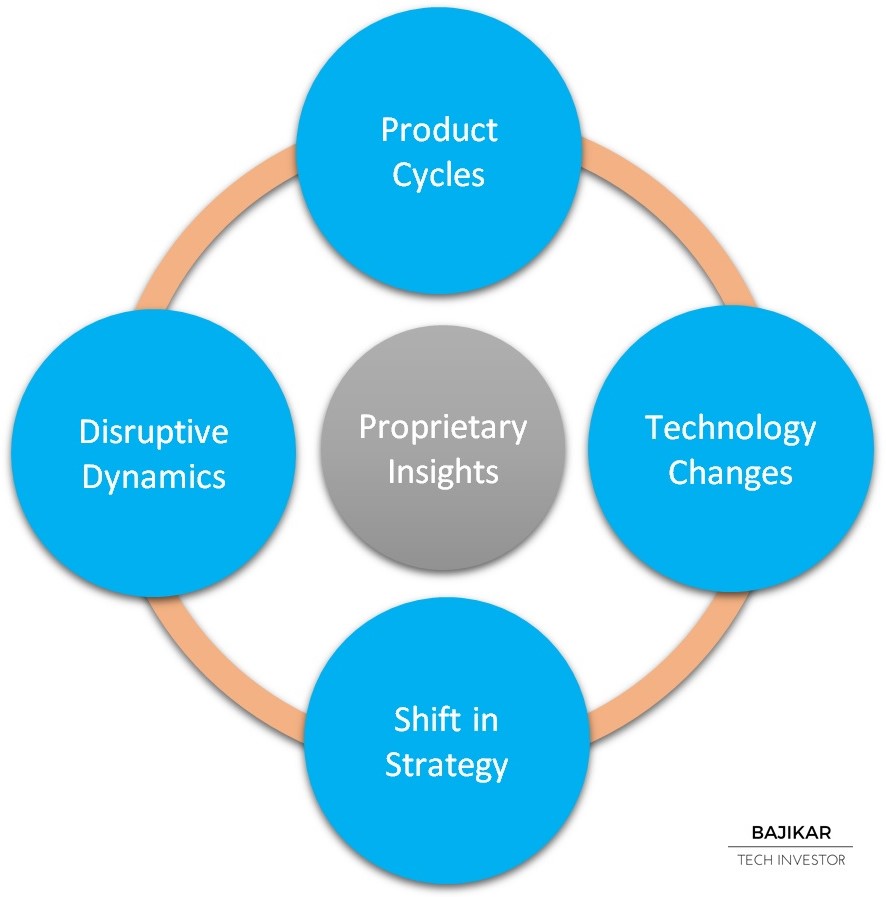

The chart shows a few examples of what I would consider proprietary insights. The word “proprietary” signifies that you had to make an effort to first gather and then infer, interpret or extrapolate the information you collected, and that such information is not readily found in the public domain in a format that an investor might consider useful or actionable. It is probably worth clarifying that “proprietary insights” does not refer to information deemed as material non-public information (aka MNPI), which might be illegal for a public investor to possess and/or trade on.

Examples of product cycles would include sales and profitability dynamics associated with well known consumer products like iPhone/iPad, as well as lesser known products like microprocessors used for automotive navigation and control, or new capabilities like video advertising.

Disruptive dynamics can transform entire industries or sub-sectors over time, shifting the profit pool from one set of companies to another. One such secular dynamic is the shift of computing applications from on-premise data centers to the Cloud.

One example of shift in strategy would be the changes made at IBM first to exit the PC business, and later to aggressively develop and deploy Cloud Services. Another example would be Nvidia’s transformation from supplying PC graphics components a decade ago to supplying computing and visualization solutions for Cloud Services as well as Automotive markets.

Technology changes refer to deeper underlying trends that affect the entire industry and even adjacent industries in a way that may not be noticeable to the casual observer. One example of such a change is the ongoing deceleration in Moore’s Law scaling of transistor size, which is impacting the cost economics of semiconductors.

While the internet has democratized access to information, distilling vast amounts of information into coherent and actionable insights will likely remain a specialized task, at least until machine learning catches up. In the interim, if you have academic training in engineering or the sciences, and/or have worked for a technology company, then you might have an inherent advantage over the average investor when it comes to analyzing tech stocks.

The technology industry is characterized by rapid change driven by innovation not just in products but also in business models. Identifying such changes early enough to capitalize on them in the form of carefully chosen investments, is an activity that many an investment manager aspires to accomplish. As I discussed in my post titled 4 ways to beat the market, proprietary insights can be a key driver of portfolio outperformance, if executed as part of a disciplined equity research process. Also see: Analysis vs. Insight – The Machines Are Coming!